The special purpose acquisition company (SPAC) market has been extraordinarily busy in the past two years. While potential new disclosure requirements from the US Securities and Exchange Commission may slow the pace of SPAC activity in the future, associated litigation will likely continue, with each type of litigation having unique characteristics and bringing various considerations for estimating damages. In “Damage Calculations and Other Trends in SPAC Litigation,” Principal Amit Bubna and Manager An Wang examine potential issues in SPAC-related litigation—conflicts of interest, material misrepresentation and omission, and breach of contract, among others—several of which arise from the distinctive structure of SPACs. Drs. Bubna and Wang discuss common methodologies and considerations in calculating damages in this context and conclude that estimating damages will require careful evaluation of all the transactions.

Involvement of PIPEs in SPAC deals

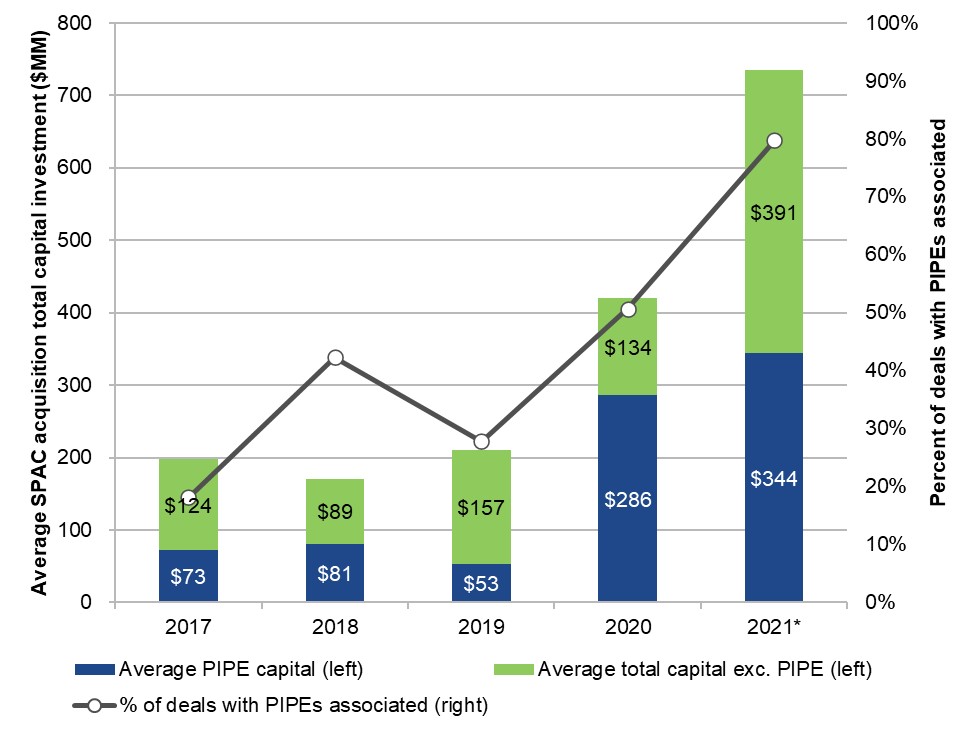

| The success of a SPAC and associated de-SPAC transaction depends on a number of participants. Private investment in public equity (PIPE) investors are increasingly common in de-SPAC transactions. |  |