Special purpose acquisition companies (SPACs) have received increased attention since the start of the pandemic. The weekly count on Google search for the term “SPAC” increased by an average of about 9% between March 2020 and February 2021.[1] There has also been a corresponding rise in SPAC-related litigation in US federal and state courts. This article provides an overview of the SPAC market and the landscape of SPAC litigation.

Overview of the SPAC market

SPACs are companies with no specific business operations—typically called “blank check” companies—that go public through initial public offerings (IPOs) to raise money to acquire another company. The search for a suitable merging target is led by a small group of experienced executives, often referred to as sponsors, and they typically have up to 18 months to announce the acquisition plus another 6 months to complete it. After a merging target is identified and the transaction approved by shareholders, the acquisition proceeds using the capital raised through the SPAC’s IPO as well as additional capital in the form of “private investment in public equity” (PIPE). Once the acquisition is completed, the SPAC is “de-SPACed,” and the merged entity becomes a regular public company. Sponsors are rewarded with a certain percentage of the equity of the merged entity, often 20%, once the merger is consummated.

Although blank check companies are not a new phenomenon, SPACs in particular have experienced rapid growth in recent years. We provide evidence of the growing prominence of SPACs as a source of capital, the expediency in completing de-SPAC transactions, and the role of PIPEs in these transactions.

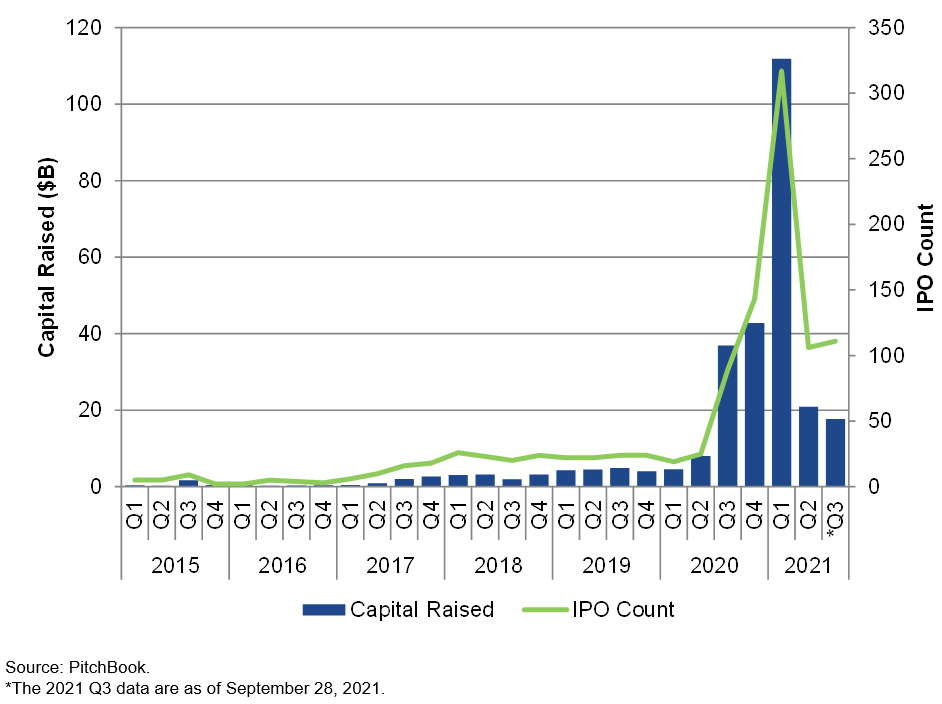

Capital raised in SPAC IPOs increased from less than $5 billion per quarter in 2019 to more than $35 billion per quarter in the second half of 2020, reaching a peak of about $110 billion in the first quarter of 2021.[2] The count of SPAC IPOs also reached a historical high of 317 in 2021 Q1. While the capital raised through SPACs and the count of IPOs have both cooled off since the 2021 Q1 peak, SPACs remain an active channel for raising capital. Offer counts remain high by historical standards—106 SPAC IPOs in 2021 Q2, the fourth-highest quarter of all time, and 111 in 2021 Q3 (as of 9/20/2021), the third-highest count of IPOs.[3] Figure 1 shows how the number of SPAC IPOs and the total capital raised skyrocketed in late 2020, peaked in 2021 Q1, and then began to stabilize.

Figure 1: Aggregate capital raised and count of SPAC IPOs by quarter

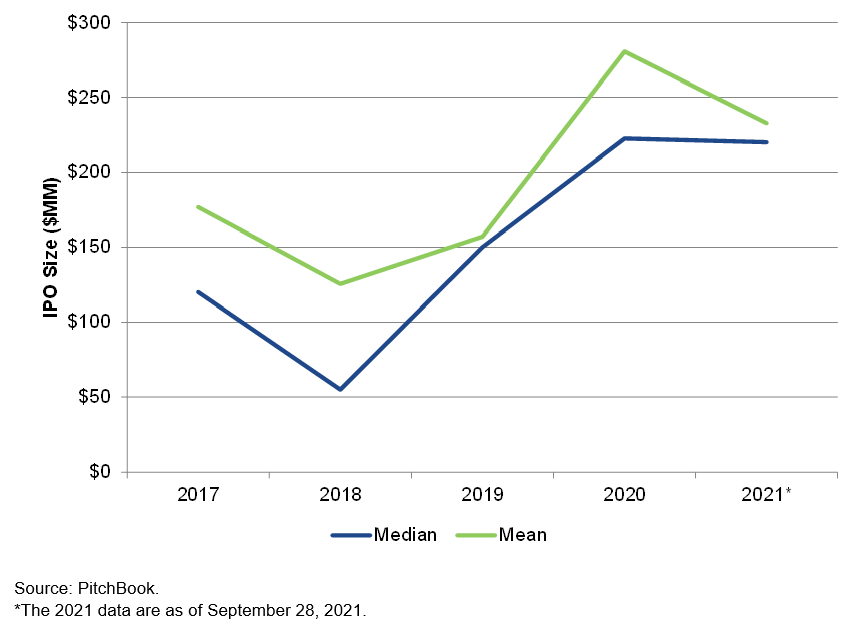

Figure 2 shows the median and mean SPAC IPO size in millions of dollars. Both the average and median peaked in 2020 then leveled off in 2021, indicating calmer market conditions around SPACs.[4]

Figure 2: SPAC IPO size by year

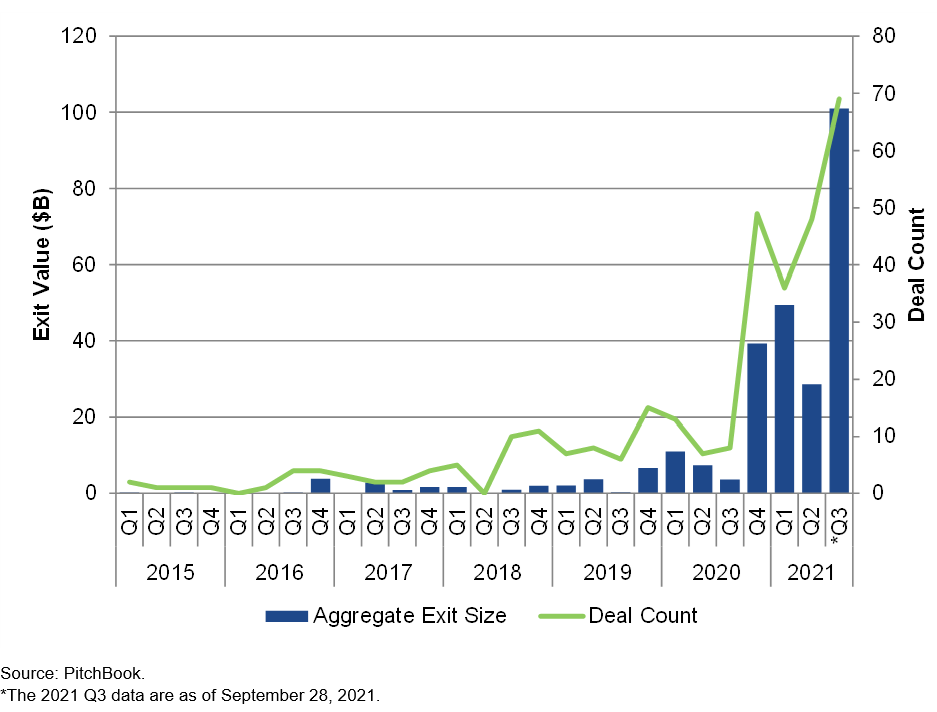

SPAC acquisition activity has increased substantially in recent quarters, as SPACs from the IPO boom in 2020 and early 2021 find acquisition targets.[5] Figure 3 shows that 2021 Q3 was the largest quarter on record in terms of both the total value of the acquisition (“exit value”) and the count of SPAC acquisitions, with the three preceding quarters making up the next three largest quarters.

Figure 3: Exit value of SPAC acquisitions and deal count by quarter

Exit values have risen hand in hand with the growing use of PIPEs and increasing average deal size.[6] The use of PIPE deals has allowed SPACs to raise capital beyond what they raised during their IPOs. PIPE investors are usually large private investors, like hedge funds or mutual funds. The SPAC will either issue new shares or its shareholders will sell shares to PIPE investors. PIPE deals are a vehicle for SPACs to get more capital after their IPO to facilitate acquisitions of target companies with higher valuations. PIPE deals can also play a role in filling the funding gap when SPAC investors withdraw money from SPACs prior to the proposed merger.

The multitude of different stake holders through the life cycle of a SPAC from IPO to de-SPAC gives rise to a host of potentially issues that could culminate in litigations. The next section of this article provides an overview of the various jurisdictions where SPAC related litigation arose.

SPAC litigation comes in many forms

SPACs are sometimes viewed as a cheaper and quicker alternative to traditional IPOs, and possibly as a more flexible option because SPAC IPOs can include forward-looking statements that are generally not allowed in traditional IPOs.[7] Involvement of influencers in many SPAC deals has also helped SPACs make headlines.[8] However, the structure of SPACs may raise potential issues, e.g., conflicts of interest, breach of fiduciary duty, breach of contract, misrepresentation, and litigation related to these issues.

Using data from Bloomberg, we identified litigation filed in both state and federal courts that is related to SPACs. We summarize below the current landscape of SPAC-related litigation by jurisdiction, filing time, and class action versus non-class action.

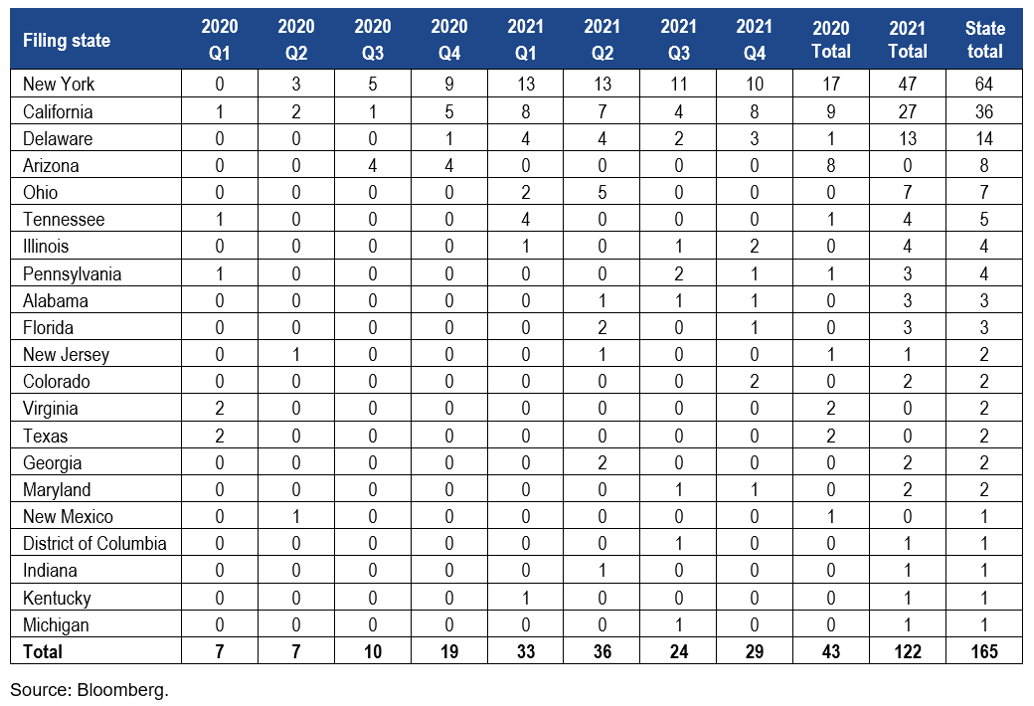

Figure 4 shows the distribution of cases in federal courts related to SPACs. From 2020 Q1 through 2021 Q4, 165 SPAC cases were filed in federal courts. An overwhelming majority of these cases took place in New York and California jurisdictions—64 and 36 of 165 cases, or 39% and 22% of all SPAC-related cases, respectively. Litigation became more common in 2021; that year saw 122 cases (or 74% of cases) compared to 2020’s 43 cases.

Figure 4: Federal cases by jurisdiction and quarter

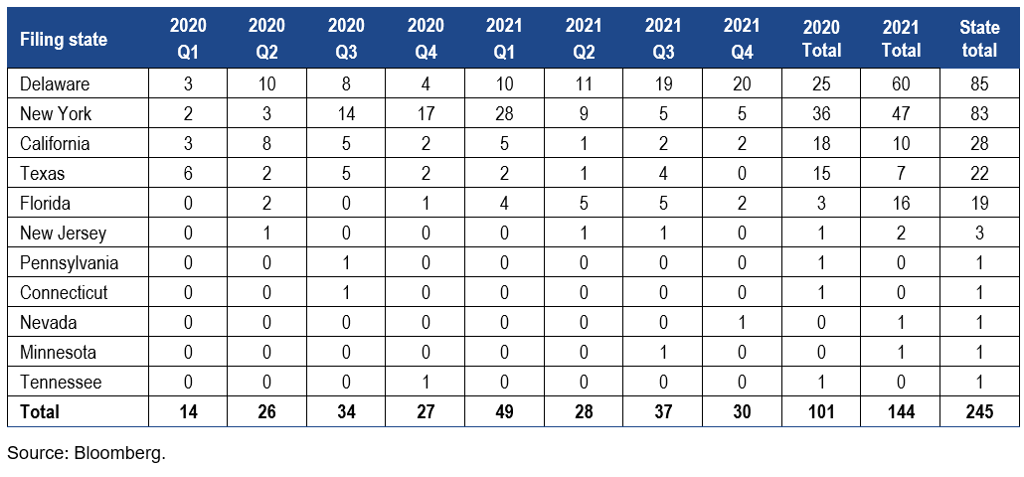

Figure 5 shows the distribution of cases filed in state courts. Cases in Delaware and New York account for 69% of all cases, and the top five states account for all but eight cases. The temporal distribution is a bit more even here, with 101 cases filed in 2020 and 144 cases in 2021.

Figure 5: State cases by jurisdiction and quarter

Among cases filed in the either federal or state court systems, several are class action lawsuits. Using data from the Stanford Law School Securities Class Action Clearinghouse, Figure 6 tabulates SPAC-related class actions filed in each jurisdiction over time. From 2020 Q1 through 2021 Q4, there were 39 class actions filed, with the highest number of suits filed in New York (17 cases) and California (12 cases).[9]

Figure 6: Class action count by jurisdiction

Recent litigation revolves around a number of issues related to either the SPAC or the de-SPAC transaction, ranging from material misrepresentation and conflict of interest to breach of contract. These are discussed in detail in our Law360 article.[10] SEC recently proposed new rules and amendments to enhance disclosure and investor protection in transactions associated with SPACs.[11] These rules, if implemented, would likely have implications for SPAC-related litigation going forward.

________________________________

[1] https://trends.google.com/trends/explore?date=2020-03-01%202021-02-28&geo=US&q=SPAC

[2] Cameron Stanfill, “Uncertainty Clouds Future for SPACs,” PitchBook, September 28, 2021, 2.

[3] Id.

[4] Id.

[5] Id.

[6] See Figure 2 in Amit Bubna and An Wang, “Damage Calculations and Other Trends in SPAC Litigation,” Law360, March 22, 2022, https://www.law360.com/articles/1475472.

[7] Michael Klausner, Michael Ohlrogge, and Emily Ruan, “A Sober Look at SPACs” (Finance Working Paper No. 746/2021, European Corporate Governance Institute, April 2021).

[8] See, e.g., Ortenca Aliaj, Sujeet Indap, and Miles Kruppa, “Can SPACs Shake Off Their Bad Reputation?” Financial Times, August 13, 2020.

[9] Rule 10b-5 is the catch-all anti-fraud provision that prohibits the making of untrue statements or omissions regarding material facts connected to the transaction of securities. See Roger E. Barton, “Caution Ahead: SPAC Litigation Trends Provide a Road Map for Directors and Officers,” Reuters, September 2, 2021, https://www.reuters.com/legal/legalindustry/caution-ahead-spac-litigation-trends-provide-road-map-directors-officers-2021-09-02/.

[10] Amit Bubna and An Wang, “Damage Calculations and Other Trends in SPAC Litigation,” Law360, March 22, 2022, https://www.law360.com/articles/1475472.

[11] “Proposed Rule: Special Purpose Acquisition Companies, Shell Companies, and Projections,” March 30, 2022, https://www.law360.com/articles/1478884/attachments/0.